Africa Eats has a unique structure, blending the best parts of a venture capital fund, a business accelerator, and Berkshire Hathaway to create an investment company optimized to support fast-growing, mission-driven, for-profit African companies.

Africa Eats focuses on funding and growing for-profit solutions to hunger and poverty across Africa. Hunger, as most Africans are farmers (or children living on a farm), and together they grow enough food for the 1.2 billion Africans, but with post-harvest losses, the continent instead imports food.

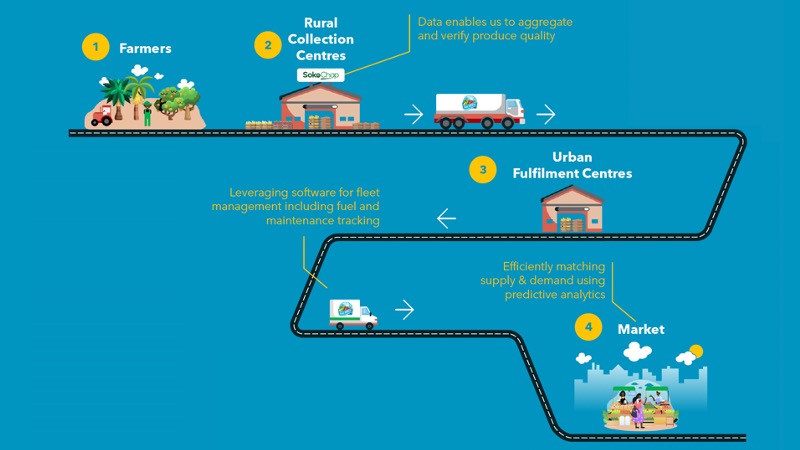

The solution is relatively simple. Buy the foods the farmers grow. Distribute that food to retailers, minimizing losses a long the way. Another term for this is building the food/ag supply chain.

This works in Africa, just as well as it worked in feeding America and Europe 100-200 years ago when those continents were similarly full of smallholder farmers, post-harvest losses, and widespread poverty. The food/ag supply chain is an overlooked key piece of infrastructure for economic growth.

The challenge is that most of of this infrastructure is missing in Africa. There are tens of thousands of micro enterprises trying to do the work, but few investors seeking tiny companies, no matter how good the solution. What happens when you fund these companies?

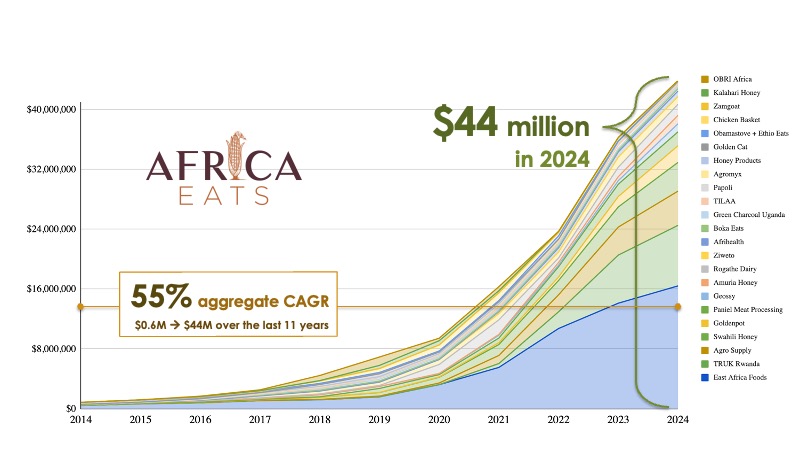

Two dozen SMEs earned over $44 million in annual revenues buying from smallholder farmers, processing the food, and distributing it to retailers.

That is a 55% compounded growth rate over the past 11 years. Built with far less than $1 of investment capital per $1 of aggregate revenues.

Some companies are growing faster than others. The oldest makes the others looks small, but in a moment we’ll share many stories of companies that were selling just tens of thousands of dollars of food a few years ago which are now selling over $1 million per year.

Goldenpot sold just $24,000 of maize flour in 2019, when we found them. With a few hundred thousand dollars of investment capital, they grew past $2 million in 2024 as the only producer of breakfast cereal in Tanzania.

Swahili Honey sold just $62,000 of honey back in 2016. We found them in 2018 and invested just €20,000. No new investment was made until 2021. Again with just a few hundred thousand dollars, this is now the second largest honey and beeswax company in Tanzania, in 2024 reaching $3.8 million in annual revenues.

TRUK Rwanda launched early in the pandemic, in April 2020. It was bootstrapped for two years, with no investment capital, not even from the founder. The company grew past $8 million in annual revenues in 2024.

The oldest and largest company in the portfolio is East Africa Foods. $100,000 in its first year of business, way back in 2013. Past $15 million in revenues in 2024. 160x growth, so far, with much more growth to come.

For more success stories, see the blog post on “fast growing SMEs“.

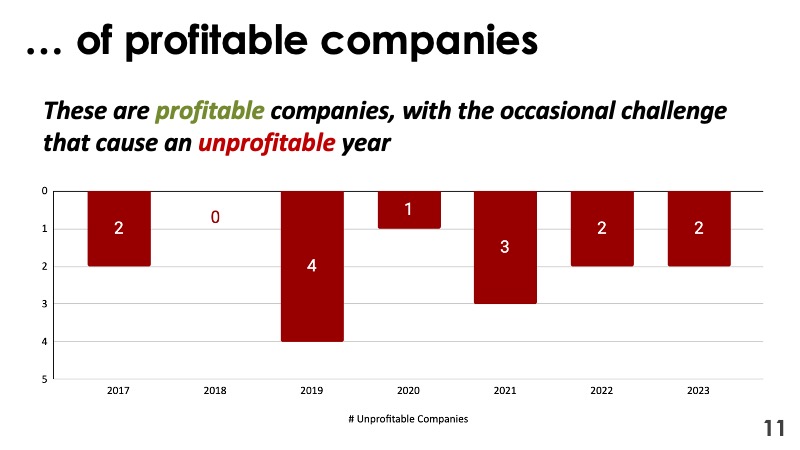

Even more amazing than the growth rate and capital efficiency is the fact that these are profitable companies. Or nearly all so.

Unlike venture capital, these companies are not burning capital to buy market share, they are earning market share by satisfying customer demand, with profitable operations.

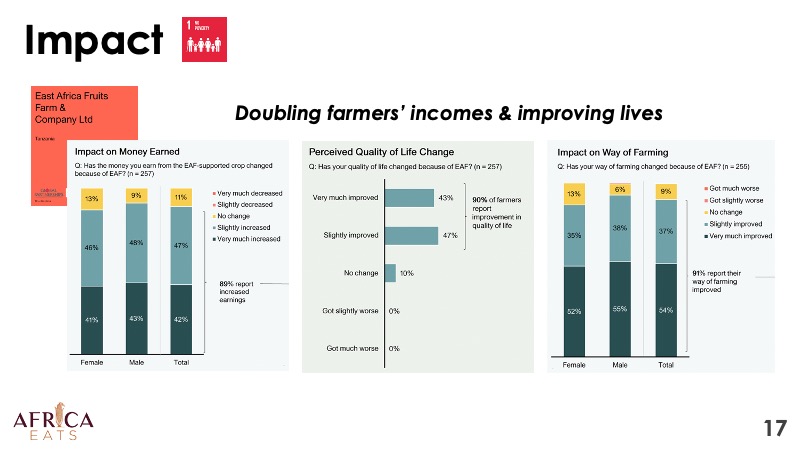

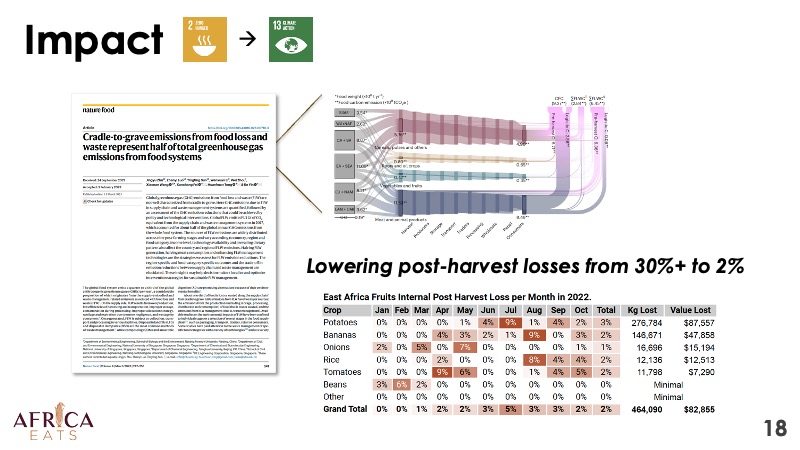

Fast-growth, profitable, and highly impactful too, with research from 60 Decibels and others showing that this activity does in fact lower poverty, decrease hunger, and greatly lower post-harvest losses. On average incomes of farmers are doubled. On average, post-harvest losses drop from the typical 30%-50% to just 2%-3%.

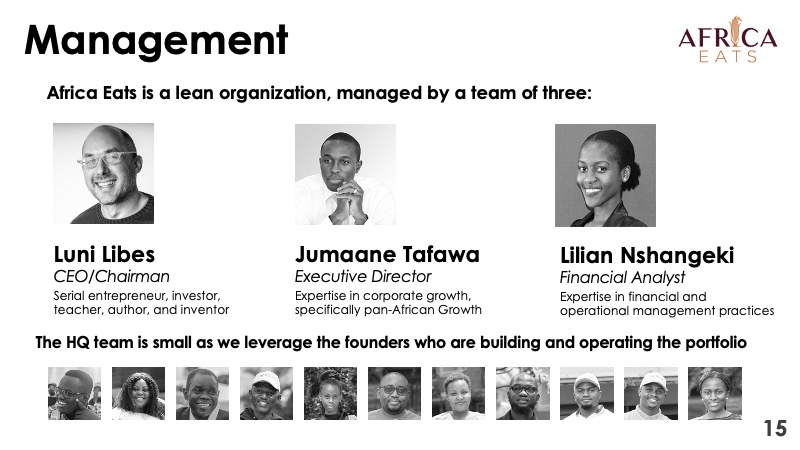

Another lesson we learned from Berkshire Hathaway is to let the companies manage themselves, providing guidance and oversight with as little holdco overhead as possible.

Back to the lesson from Berkshire Hathaway… if we don’t plan on any exits, how do equity investors earn a return? Their shares are liquid by listing Africa Eats as a public company.

Africa Eats is listed on the Stock Exchange of Mauritius under the symbol EATS, along with two of our bizi.

Investors are welcome to enjoy the continued growth, holding their shares as the bizi grow and as Africa Eats grows the portfolio of bizi.

Investors can sell shares any week, thanks to Tuesday Markets, the first market maker on this stock market. Investors can use the tuesday.africa app to buy or sell shares with a few clicks.

(For institutions interested in larger block, contact Perigeum Capital)

If you have questions, contact us for answers.