Episode 160 with Luni Libes, a serial entrepreneur, investor, and impact-driven venture builder. Luni is the founder and CEO of Africa Eats, an innovative investment company tackling food insecurity and poverty across Africa by scaling profitable, for-profit agribusinesses. He also leads SEMX, a groundbreaking initiative unlocking public capital markets for African SMEs.

Africa Eats invests in and supports early-stage, fast-growing food and agriculture companies that are solving critical supply chain inefficiencies, reducing post-harvest losses, and improving the livelihoods of smallholder farmers. Through its long-term, equity-holding model, the company has helped businesses grow 50%+ annually, transforming subsistence farmers into sustainable entrepreneurs while delivering strong returns for investors.

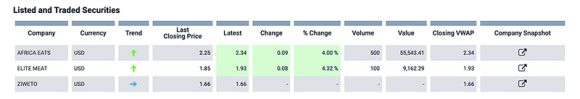

Luni shares his philosophy on impact-driven capitalism, why traditional venture capital isn’t the right model for African SMEs, and how SEMX is pioneering a new segment on the Stock Exchange of Mauritius to connect fast growing African enterprises with global investors. His mission is clear: build a thriving ecosystem where African agribusinesses don’t just survive but scale, creating lasting economic transformation across the continent.

What We Discuss With Luni

- Lessons from founding multiple businesses and investment ventures that have shaped the approach to building and growing Africa Eats.

- How Africa Eats’ long-term equity investment model differs from traditional VC funding and the reasons behind this approach.

- The benefits of Africa Eats’ “Forever” equity model for both investors and entrepreneurs compared to traditional venture capital.

- The key factors driving the impressive growth of Africa Eats’ portfolio companies, scaling from tens of thousands to millions in revenue.

- How the SEMX initiative is bridging the capital gap for African SMEs by leveraging access to public markets.