The following is an excerpt from a Sankalp Africa 2022 panel talking with real African entrepreneurs about the challenges of fast-growing companies in Africa.

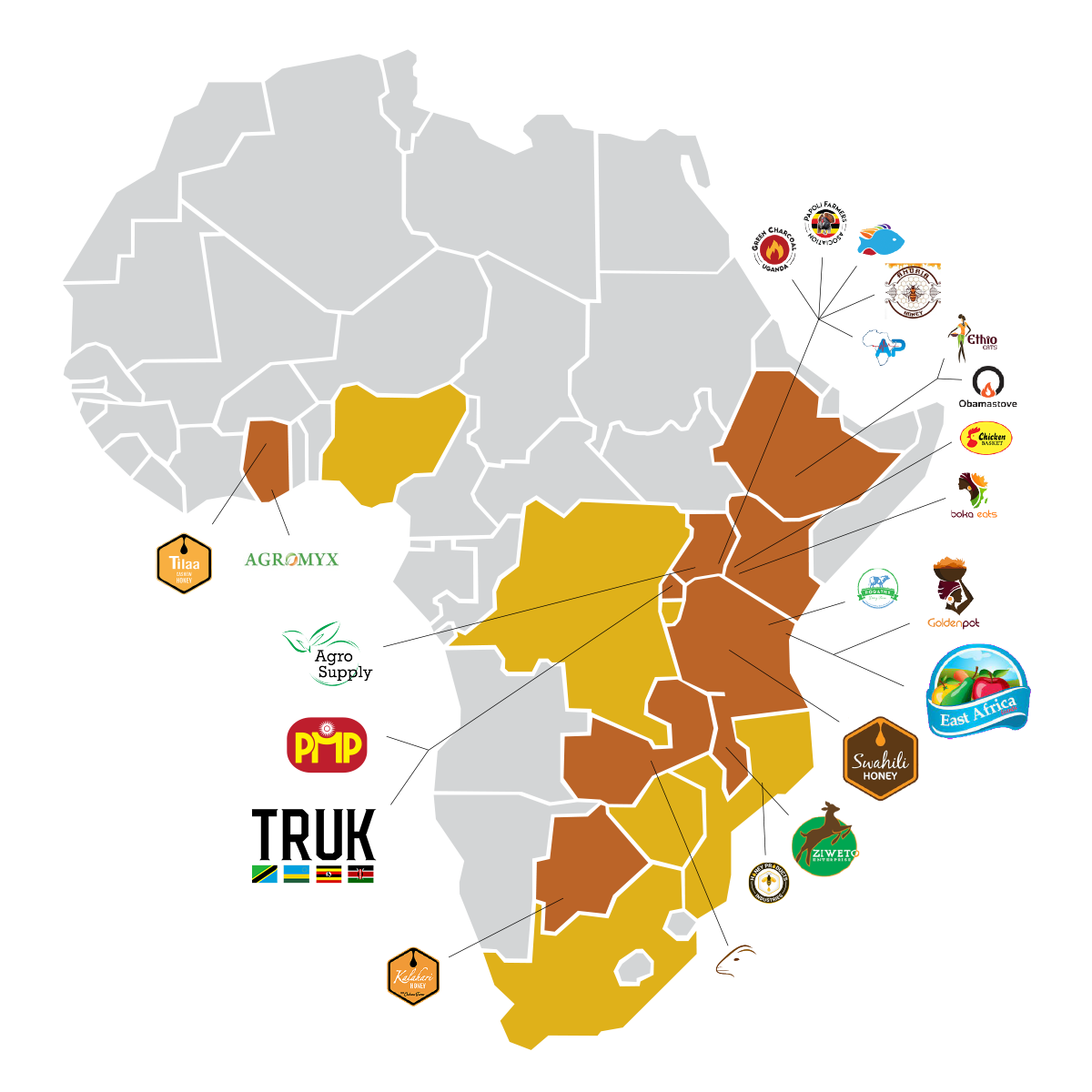

The speakers include the founders of Agro Supply, East Africa Fruits, Ziweto Enterprise, Paniel Meat Processing, Livestock Bank, and TRUK (Rwanda).