Rogathe Dairy aggregates milk across the Coastal Region of Tanzania, pasteurizing and culturing into yogurt and mtindi. Last month we visited the factory.

africaeats.com/rogathe-dairy//

Despite over ¾ of Africans being farmers or children of farmers, not every African is able to eat three meals per day. Most of that is due to post-harvest losses, with up to ⅓ of the grain and almost ½ of all the fruit and vegetables grown never making it to a plate to eat.

Because of the post-harvest losses, Africa spends tens of billions of dollars per year importing food. Ending this downward spiral of mounting debt ends when Africa is a net exporter of food.

There is far too much friction in funding the existing, homegrown, for-profit solutions to hunger and poverty too often ignored by financial institutions. Not just initial funding, but growth-stage funding and critical financial services.

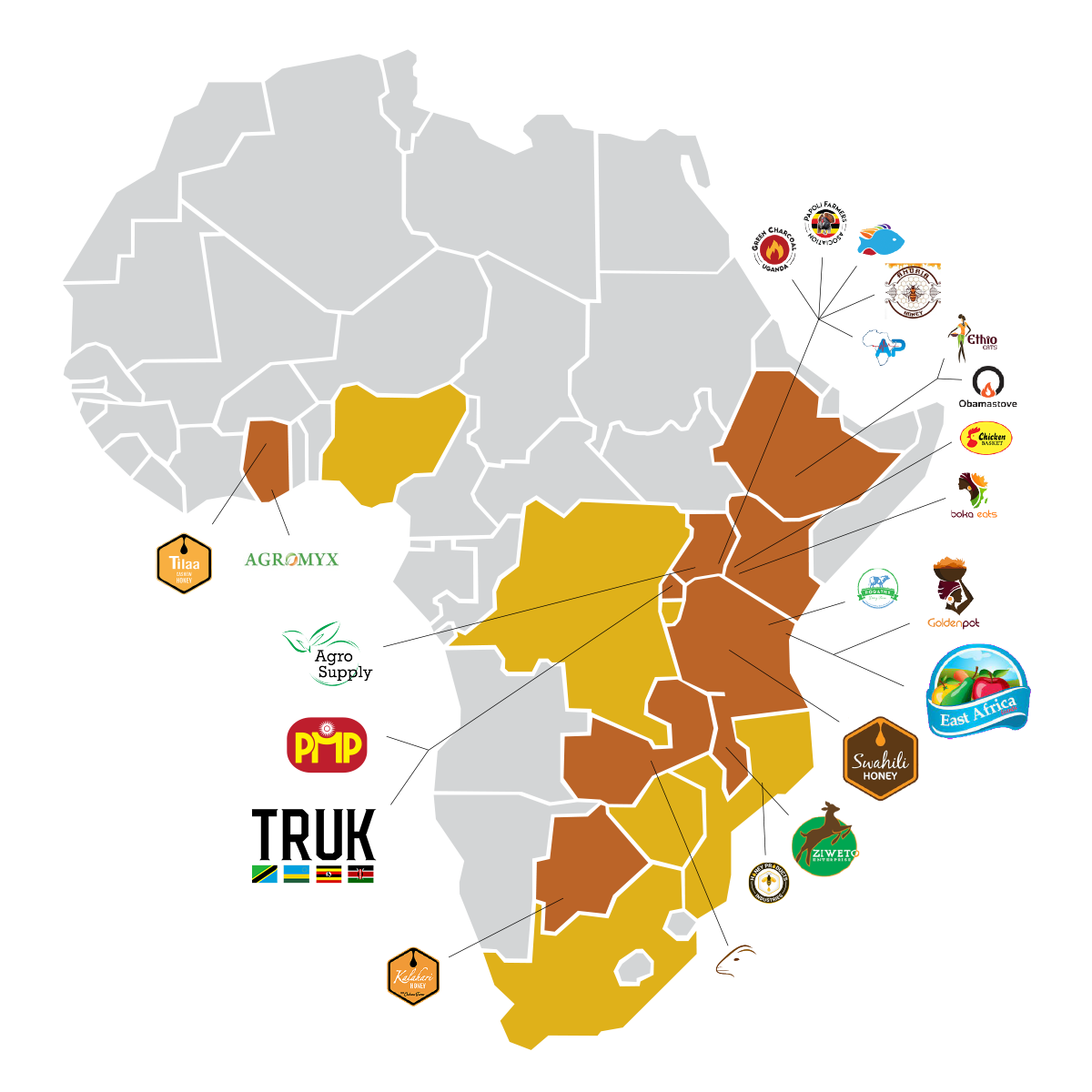

A solution for all these issues is Africa Eats, a holding company with a diverse set of African food/ag companies supporting hundreds of thousands of smallholder farmers, feeding millions of Africans.

Africa Eats does not try solving this problem from scratch, but instead begins with two dozen fledglings (graduates) of Fledge, the global network of conscious company accelerators. Dozens of young, for-profit, growing companies chosen from thousands as most likely to succeed, with impact embedded in their product or service, and who have all received two months of intense training, capital, and follow-on support. Companies which in 2022 earned over $24 million in aggregate revenues and which worked directly with over 100,000 smallholder farmers.

See how it works in more detail and contact us if you are interested in owning a piece of this fast-growing portfolio or if you can help us grow these companies even faster.

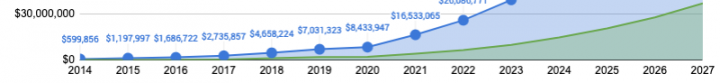

A year ago we touted $24 million in aggregate annual revenues from the bizi for calendar year 2022, up more than three-fold from 2019. For 2023, that total exceeded $36 million, which is more than 5x in four years, and up 60x over the last decade. The bigger growth stories in 2023 were: TRUK Rwanda, which tripled in 2023 to $6.4 million in annual revenues, up from zero four years earlier as the...

It’s almost time for Africa Eats’ annual “Gathering”, where all of the bizi founders fly to Nairobi for two days of facilitated discussions including a deep dive into building the missing business infrastructure for African SMEs, including a plan to unlock the capital markets. This event is unlike any other we know of. It is the day after Sankalp, but far more interactive...

There is no global authority that defines SME, but the EU sets a definition for the EU. The boundaries between “micro“, small, and medium are a mix of employee headcount with either revenues or balance sheet.

Africa Eats specializes in turning micro enterprises into small and then medium-sized enterprises. See Fast-growing SMEs for examples of seven success stories.

Ziweto Enterprise started as a wholesaler and retailer of agrovet supplies, and they have grown to be the largest such company in Malawi. Last year Ziweto Nutrition Solutions was opened, manufacturing animal feeds to sell in those stores. Last month we visited the factory in Lilongwe, Malawi.

Ziweto Enterprise

About Us

Africa Eats’ mission is to lower hunger and eliminate poverty across Africa. Dropping post-harvest losses from 40% to 2% is one way to lower hunger. The other is increasing the incomes of farmers, which simultaneously and directly eliminates poverty. On average, the bizi double the income of their farmers. We’ve seen that proven in the first 60 Decibels report on the farmers of East...

It’s quite rare when the U.S. media has something nice to say about Africa. This week was an exception, in The New York Times, in an interactive digital article about the population growth and economic growth of the African continent. The median age in Africa here in 2023 is just 19 years old, nearly a decade younger than in India and the rest of South Asia. By 2050, more than 1/3rd of all...

Which sounds and feels biggest? $2.83 million per month $8.5 million per quarter $34 million per year Back in mid-2020, when Africa Eats was founded, we were touting total aggregate revenues across the whole portfolio of companies as $7 million. That was the actual revenue earned by the “bizi” in 2019. In the three months of Q2 2023 (April-June), the bizi earned $8.5 million. That is...

Venture capital and angel investing are realms filled with unspoken assumptions. One such assumption is that companies should burn through substantial capital before even considering profitability. This notion is misguided! Countless startups, often overlooked by these investors, are compelled to be profitable to survive. If these investors took a moment to recognize these startups, they would...