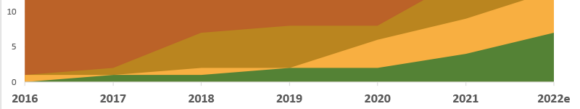

The six months of 2022 continues the revenue growth we’re used to at Africa Eats. An aggregate of $11.6 million was earned by our portfolio companies, putting them on track to reach $24M-$25M for the whole year. To put this in some perspective, when we launched Africa Eats back in 2020 we were touting a total of $6.7 million in revenues in 2019. The same portfolio earned that just in Q2...