Africa Eats may only have been around since 2020, but 14 of our portfolio companies have been operating since at least 2016. What is amazing to see is the growth of these companies.

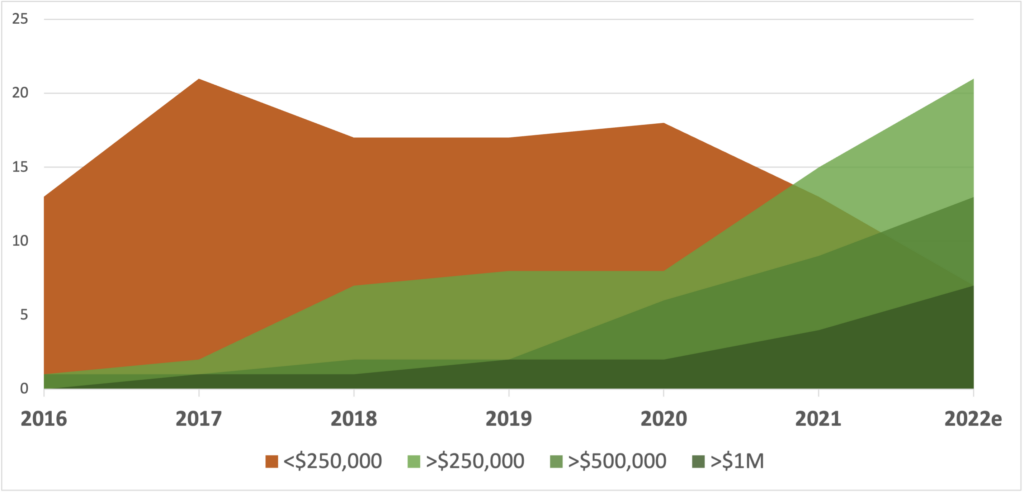

We’ve previously touted their growth in terms of aggregate revenues. Today let’s instead look at their growth in terms of individual scale, dividing them up by those above $250,000 in annual revenues (USD equivalent), those above $500,000, and those above $1 million.

The facts

Back in 2016 all but one of companies was under $250,000 in revenues, and the largest was not yet earning $1 million. In 2017 the number of companies grew to 23, with that previous largest surpassing the $1 million annual milestone, but just one other above $250,000. By 2020, there were 26 companies (just three more), with then 8 above $250,000 and still just two above $1 million.

That year was when Africa Eats arrived to help these companies grow, and wow did they grow. By the end of 2021, the number of companies above $250,000 nearly doubled to 15 with 9 of those above $500,000 and 4 passed the $1 million annual revenue milestone.

The 2022 values in the above graph are the projections from the entrepreneurs as of January 2022. The expectations are 21 above $250,000, 13 above $500,000, and 7 earning more than $1 million for the year.

The analysis

Growth capital helps companies grow. No surprises there.

What you can’t see from the graph is how the companies managed this growth. This wasn’t a process of “burning” capital, as we typically see from venture capital funded companies. There wasn’t much spent by any of these companies on marketing. Instead the growth came from scaling up operations to meet customer demand. The growth capital was mostly spent on operational capital, equipment, and trucks. And the results of that are crystal clear.

The conclusion

Find great companies, add growth capital, and the result are bigger, stronger, more scalable companies.

This analysis demonstrates what happens when the “missing middle” of capital is deployed. It proves it is possible to find companies that are tiny (often under $100,000 in annual revenues), and within five years help them triple or 5x or 50x in size.

We’ve no doubt this result is unique to these few dozen companies. We suspect if given sufficient capital we could replicate this result for 1,000 SMEs or even 10,000 SMEs across the continent.

And while we don’t yet have data on growing companies from $1 million to $10 million, these companies are on that path too, and we’ll add that milestone and show off the result of that growth well within the next five years.