Africa Eats shared the highlights of Q3 2025 on a Zoom call with shareholders, recorded below:

00:00 Welcome 21:30 Foward Looking 30:20 Q&A

See tuesday.africa/EATS for the latest share price, audited financial reports, announcements, and news.

Despite over ¾ of Africans being farmers or children of farmers, not every African is able to eat three meals per day. Most of that is due to post-harvest losses, with up to ⅓ of the grain and almost ½ of all the fruit and vegetables grown never making it to a plate to eat.

Because of the post-harvest losses, Africa spends tens of billions of dollars per year importing food. Ending this downward spiral of mounting debt ends when Africa is a net exporter of food.

There is far too much friction in funding the existing, homegrown, for-profit solutions to hunger and poverty too often ignored by financial institutions. Not just initial funding, but growth-stage funding and critical financial services.

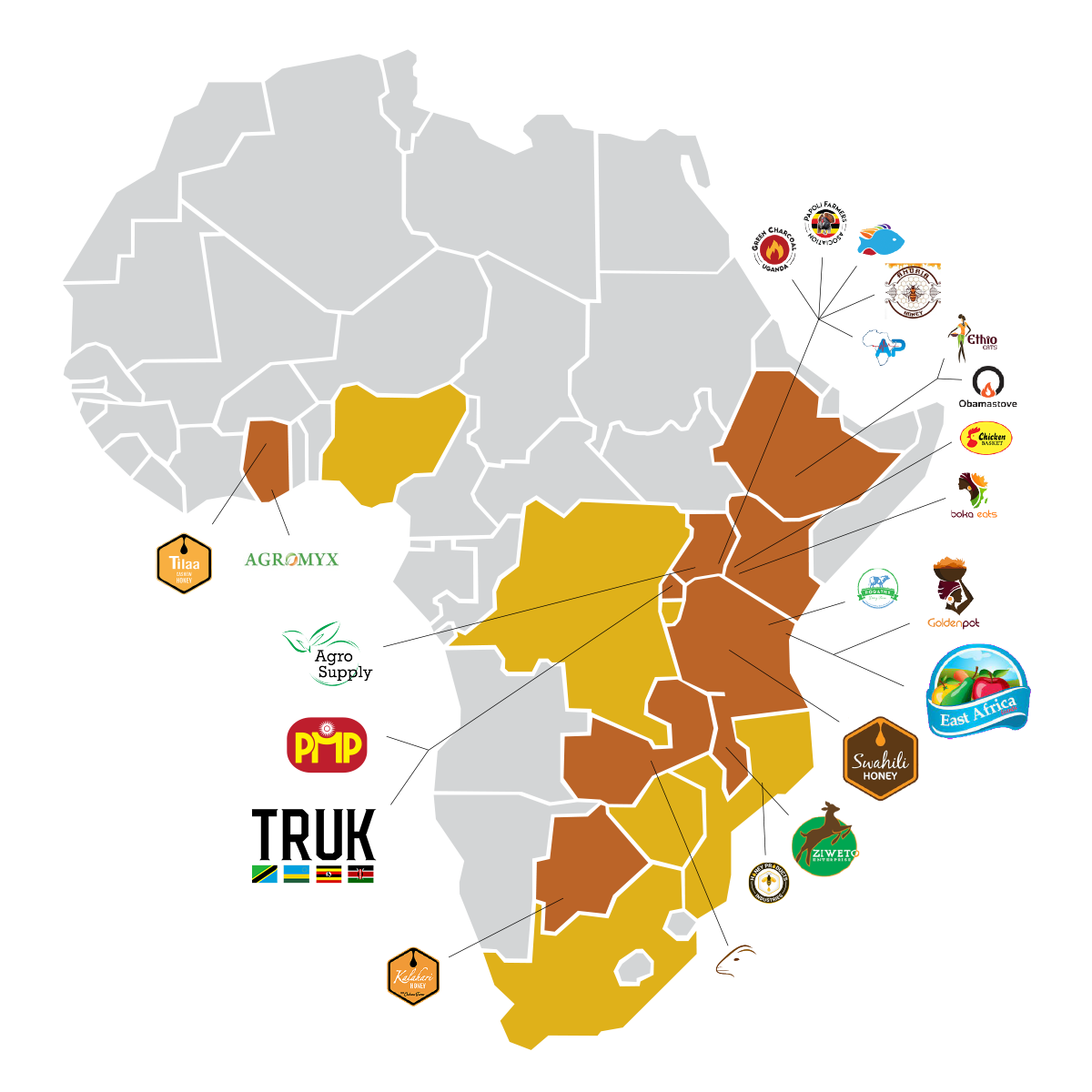

A solution for all these issues is Africa Eats, a holding company with a diverse set of African food/ag companies supporting hundreds of thousands of smallholder farmers, feeding millions of Africans.

Africa Eats does not try solving this problem from scratch, but instead begins with two dozen fledglings (graduates) of Fledge, the global network of conscious company accelerators. Dozens of young, for-profit, growing companies chosen from thousands as most likely to succeed, with impact embedded in their product or service, and who have all received two months of intense training, capital, and follow-on support. Companies which in 2022 earned over $24 million in aggregate revenues and which worked directly with over 100,000 smallholder farmers.

See how it works in more detail and contact us if you are interested in owning a piece of this fast-growing portfolio or if you can help us grow these companies even faster.

Africa Eats shared the highlights of Q3 2025 on a Zoom call with shareholders, recorded below:

00:00 Welcome 21:30 Foward Looking 30:20 Q&A

See tuesday.africa/EATS for the latest share price, audited financial reports, announcements, and news.

Recorded live at AFSIC, the continent’s leading investment conference connecting investors, dealmakers, and African business leaders.

afsic.net

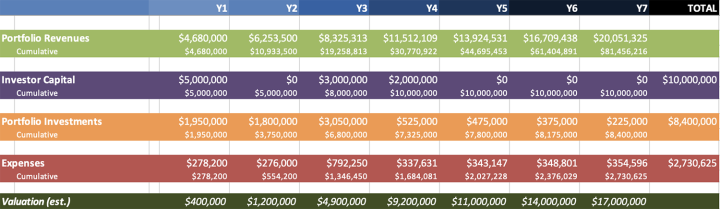

Seven years is a very long time to try and predict into the future. Most new businesses do not attempt to project that far out. Normally it is just 3 years. 5 years at most. In the latest quarterly report, Luni Libes (CEO) took a look back at the very first financial model, built back in August 2018, seven years and two months ago. If Y1 is 2018, then Y7 is 2024, which means that we can actually...

Afrihealth improves lives by raising the value of livestock, providing smallholder farmers access to quality and affordable veterinary and animal nutrition products through a network of hundreds of local agrovet shops in Eastern Uganda. Livestock constitutes 3.8% OF GDP in the whole of Uganda. Eastern Uganda has a total of 11 million chickens, 2.6m goats, 2.5m cattle, 400,000 sheep, 700k pigs...

Africa Eats’ 2026 Annual Gathering will be on February 5th, 2026 in Nairobi, Kenya. This is the event where we fly all of the bizi founders fly to Nairobi for 2-3 days of facilitated discussions and training, and where we invite guests to join for the first of those days. Screenshot Africa Eats is not a fund. We are not investor and investee. Africa Eats is the HQ team and all the bizi...

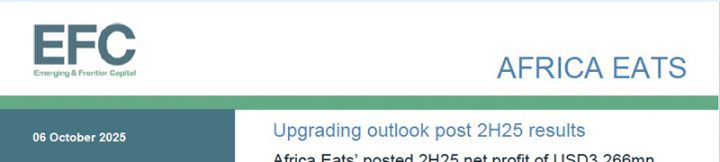

One of the benefits of owning a publicly listed company is far greater transparency into a company’s financials and workings, and that includes analysis of all that information by 3rd party analysts. The first of these to cover Africa Eats is Emerging & Frontier Capital (EFC), “an independent equity research house specialising in emerging and frontier markets, offering unbiased...

“The business model we invest in is pretty simple. Pick a crop, find a few hundred farmers who grow it, buy from them, do something with the crop, and sell to retailers. That’s the model.” – Luni Libes It sounds almost obvious, yet the portfolio’s performance is astonishing: Africa Eats portfolio companies have grown revenues by a staggering 55% CAGR in 11 years. No blue-ocean strategy here...

Nyota Limited is a food manufacturing company based in the heart of Ngong Hills and trading under the brand names Frozen Isle and Ntamu. We are proudly Kenyan utilizing the best quality of locally available vegetables, fruits, and beans. Our vegetables are grown in the rich soils of our Kenyan Highlands. Our vegetables are carefully grown and harvested at their prime. Nyota’s vegetables are...

We often talk about the resiliency of African entrepreneurs, and how the bizi founders refuse to give up when business gets difficult. Well… once upon a time, there was a $1.1 million annual revenue bizi whose revenues dropped to zero when a flood wiped out all of their farmers’ crops. I less resilient entrepreneur would have stepped away for good. Brigitha Faustin is not one to give...

Africa Eats, Elite Meat, and Ziweto all listed as public companies on the Stock Exchange of Mauritius nine months ago, today. How are are the companies doing? All three share prices are up: +15.6%, +10.3%, and +15.8%. There are 50 companies listed on the main board of this stock exchange. Sorted by market capitalization, the companies are smaller than average, ranking 33rd, 43rd, and 45th. Which...