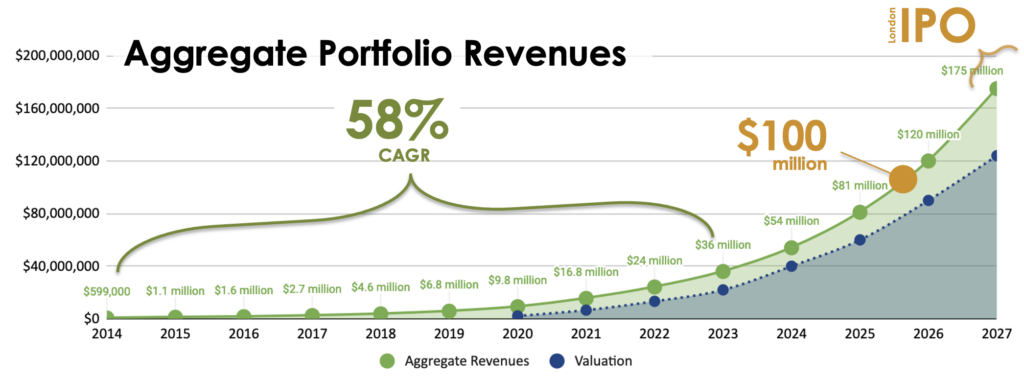

8 of the portfolio companies within Africa Eats were started in or before 2014. The rest within the last five years. Back in 2014, the cumulative revenues from those 8 companies was $600,000, and ten years later those companies were 60x larger, with $36 million in aggregate revenues.

The compounded annual growth rate (CAGR) since 2014 is 58%. That is nearly 2.5x growth every two years over the past decade, slowing only a few percentage as these companies scale up from tiny to millions in annual revenues.

Looking out into the 2020s, our expectation is that as these companies get larger and larger, their annual growth rate will slow, but the projections show an aggregate of over $100 million by 2025.

The goal for Africa Eats is to file for an IPO in Africa in the next 18 months, and to be publicly listed on the London Stock Exchange well before the end of the decade. We explain in Why Forever why we think this is a great idea for not just these companies, nor Africa Eats’ investors, but for Africa as a whole.

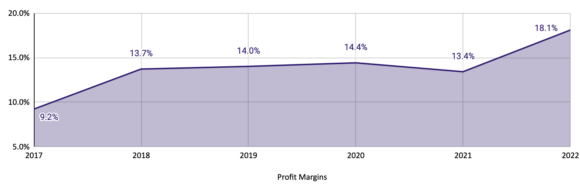

To do that requires no just fast growing companies, but profitable companies. That is not a problem as nearly all have been profitable since their founding.

Everyone eats, and as the African population doubles in the next 15 years, the opportunity to feed Africa only grows.